- Personal

- Membership

- Membership

- Rates & Fees

- Checking

- Checking

- Personal Loans

- Personal Loans

- Wealth Management

- Investment Services

- Financial Advisors

- Resource Center

- Business

February 21, 2025

Understanding Compound Interest: Making Time Work for You

Even if your retirement is still decades away, saving should be a priority. Why? When it comes to maximizing your dollar, time really is money. That’s why you need to understand compound interest.

Make the most of compound interest

You’ve likely heard us say it before — start saving for retirement as early as possible — but you may not have considered the math behind the savings equation. The real magic is compound interest. How does it work?

- Save money in a diverse portfolio that earns interest.

- Watch as your new higher total earns even more interest.

- Rinse and repeat. As your balance grows, your interest compounds, allowing you to earn even more, and this continues over and over.

That’s the bottom line — and why it’s so important to save early and often. There’s more time for compounding to work its magic.

Understand the value of time

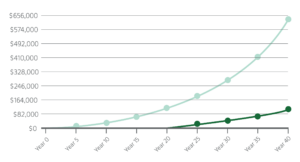

Consider two simple scenarios to help you visualize the impact of time on your savings outcome.1 Both scenarios assume the same initial contribution, monthly contribution and interest rate.2 The only difference? Time.

1Figures quoted are for illustrative purposes only and are not necessarily indicative of past or future results of any specific investment. They may or may not include consideration of the time value of money, inflation, fluctuation in principal or, in many instances, taxes.

Scenario 1: Saving for 20 years

If you start with just $1,000 and save $50 per week ($200 monthly) for 20 years, you end up with about $114,500. While this is meaningfully better than not saving at all, this amount probably won’t stretch through a long retirement and may leave you with an expenses gap.Scenario 2: Saving for 40 years

Let’s say you start with the same initial amount of $1,000 and save the same $50 per week, but you begin saving earlier — with 40 years to spare until your goal retirement age. Now, you may end up with about $643,500. The extra 20 years of compounding more than quintuples your total and provides a much more comfortable figure to support you during retirement.Plus, this illustration doesn’t take into account that as a person’s career progresses, they’re typically able to increase the amount they’re contributing to retirement savings, which means even more compounding to take advantage of. To calculate savings outcomes based on different interest rates and contributions over time, you can use the U.S. Securities and Exchange Commission’s compound interest calculator.

Our advice? Start early, save often.

Imagine what compounding interest could do for you. Even small monthly contributions will add up. Disciplined, consistent saving habits are the key to safeguarding your financial future.

2The graph shows an estimate of how much your initial savings plus monthly contributions can grow over time, assuming an 8% interest rate and annual compounding. Remember that adjustments in any of those variables will change the outcome.

Posted In:

How to Find Your Routing & Account Numbers

When you make a payment online, by phone or on a mobile device, you may be asked for our routing number and your checking account number. Credit unions and banks use these numbers to identify accounts and make sure money gets where it’s supposed to be. You’ll also need to provide your routing and checking account numbers for:

- Direct deposits

- Electronic checks

- Military allotments

- Wire transfers

Where to Find Your Routing & Checking Account Numbers

Your personal checks include both our routing number and your account number, as shown on the Grow check example below.

Don’t have a Grow check? No worries.

Visit any Grow store and ask for a Direct Deposit Form. It lists both your routing number and checking account number.

Making a Loan Payment

Incorrect Phone Number Alert

We’ve identified an incorrect phone number listed in a letter sent to a select group of new members with auto loans. The incorrect number is NOT affiliated with Grow. Please be sure to use our official phone number, 800.839.6328, which you can verify on our Contact Information page. For your security, keep your personal information safe and avoid sharing it over the phone, email or text message. We will never ask you for your credit or debit card security code, expiration date or PIN, login security codes, or your online banking password.

When it comes to making payments, we try to make it as painless as possible to pay your loan every month. We have several different ways to pay, including convenient online options.

Pay Online

You have two ways to pay online by transferring funds from another bank or credit union.

- Grow Online Banking (Preferred payment method for any loan)

This is the simplest way to pay your loan. You can make one-time payments or set up automatic recurring payments in Grow Online Banking. Once you log in, select “Transfer/Payments” from the menu. If you’re not enrolled in Grow Online Banking yet, you can set up your account in just a few minutes.

Log In

- Debit Card or ACH (Available for auto, personal loans and HELOCs)

Note: ACH and debit card payments are not available for credit cards or most mortgages, except HELOCs.

We accept ACH payments with no additional fees, consumer Mastercard® and Visa® debit cards with a convenience fee of $4.95, or commercial Mastercard® and Visa® debit cards with a convenience fee of 2.95% of the payment amount. To get started with an online ACH or debit card payment, select Pay Now below.

Pay Now

Pay by Mail

You can also pay any Grow loan by check through the mail. Please remember to include your account number and Grow loan number on the check. (For credit card payments, please do not write your 16-digit credit card number on the check, which can cause a delay in processing the payment.)

Address for auto, credit card, personal loan and HELOC payments:

Grow Financial Federal Credit Union

P.O. Box 75466

Chicago, IL 60675-5466Address for personal first or second mortgages and home equity payments:

Grow Financial Federal Credit Union

P.O. Box 11733

Newark, NJ 07101-4733You Are About To Leave GrowFinancial.org

At certain places on this site, there are links to other websites. Grow Financial Federal Credit Union does not endorse, approve, represent, certify or control those external sites. The credit union does not guarantee the accuracy, completeness, efficacy, timeliness or accurate sequencing of the information contained on them. You will not be represented by Grow Financial Federal Credit Union if you enter into a transaction. Privacy and security policies may differ from those practiced by the credit union. Click CONTINUE if you wish to proceed.