- Personal

- Membership

- Membership

- Rates & Fees

- Checking

- Checking

- Personal Loans

- Personal Loans

- Wealth Management

- Investment Services

- Financial Advisors

- Resource Center

- Business

Credit

Education

Being Smart About Credit Can Make All The Difference

Understanding how credit works is an essential stop on the road to financial freedom. From financing a new vehicle to obtaining a mortgage on your dream home, credit plays an important role in your financial life. A good score can open doors to possibilities, while a poor score may limit your options.

The good news is that even if you don’t have a great credit score, you can fix it with actions and behaviors that will positively impact your score, like making payments on time. Your score won’t improve overnight, but by doing all the right things consistently, you can be sure it will go up over time.

Maintaining a proactive approach to your credit by keeping an eye on your credit reports and seeking to improve your credit score will help you make informed financial decisions. Let’s start with the basics to get you on your way.

What Makes Up Your Credit Score

You hear a lot about credit scores, but how does the number add up? For our purposes, we’ll be discussing the FICO score, the most commonly used score in the country. Basically, it’s determined by five key factors:

Payment History

This is the most important factor, making up more than a third of your score. Why? A solid payment history means you take financial commitments seriously and pay your bills on time. Lenders like to see that.Credit Utilization

A fancy term for everything you owe—student debt, auto loans, credit cards and others—compared to your total available credit. Experts recommend keeping your credit utilization ratio below 30 percent. It’s the second most important factor in your score because lenders won’t lend if they think you’re in over your head.Length of History

Still have the very first credit card you’ve ever opened? Good! Having established credit accounts in good standing shows you’re responsible with credit. It’ll take more than a few years to start scoring well in this area, and the longer the better. As your credit accounts age, assuming they stay in good standing, so will the history component of your score, which makes up about 15% of the total.Type of Credit

A small factor but important, this looks at the type of debt you have, whether secured (like a mortgage) or unsecured (like most credit cards). Having a diversity of account types in good standing can boost your credit score because it shows that you can handle a variety of debts, such as credit cards, student loans or a mortgage.Credit Applications

While this is only 10% of your score, you can hurt yourself here by suddenly applying for lots of new credit in a short period. That’s taken as a sign you may be on thin ice financially. It’s wise to spread out what are referred to as “hard inquiries” of your credit report, which happen when a lender runs a thorough check on your credit. Be careful to note that more and more places have begun running hard credit inquiries, including cell phone providers and even furniture leasing stores.

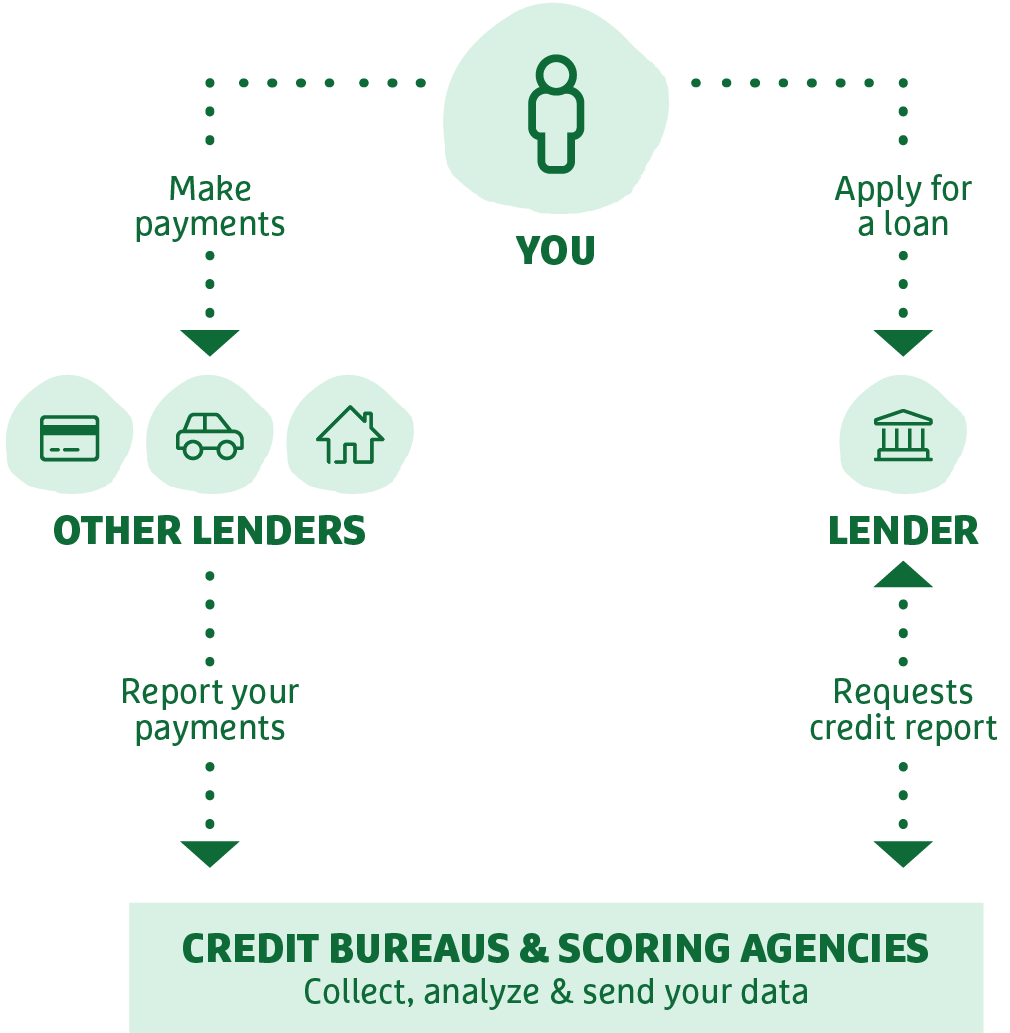

Who Comes Up With the Number

Your unique credit score is calculated by a scoring agency based on data from a credit bureau, which collects the data from your lenders, including banks, credit unions, credit card companies and more. There are many credit bureaus across the U.S., but the primary three used by the majority of financial institutions and businesses are Equifax, Experian and TransUnion. While multiple scoring models exist, the most commonly used credit scoring models are FICO and VantageScore, both of which create a score between 300 and 850—the higher the better.

How To Improve Your Credit

Credit scores are measured on a scale of 300 to 850, with 700 or higher being the goal. Not there yet? Don’t worry. Your score isn’t permanent, and here’s how you can improve it:

Make payments on time. Automated bill paying services, such as Grow Online Bill Pay, can ensure that your payments are made on time, every time. Most credit cards offer an automatic payment option too.

Reduce your debt. Got a maxed-out card? Un-max it. Make an effort to pay down or pay off unsecured debt, like credit cards and student loans. Carrying a small balance from month to month is fine, but you can avoid interest by paying your credit card off each month.

Don’t open too many new cards. Remember the Credit Applications section above? You don’t want to be seen as desperate for cash by opening multiple new cards. Plus, don’t close out old cards, for two reasons. First, closing the card reduces the amount of available credit you can draw on. Second, you lose that history of credit management when you close an old card, so keep it around if you can.

Monitor your report and dispute errors. Keeping a close watch on your credit will arm you with information and help you catch fraud or errors quickly. Dispute any errors with the credit bureaus, and if needed, add a consumer statement, a brief note on your credit report to explain your situation. Though it doesn’t necessarily raise your score, it could help provide context to lenders in the future.

Give it time. Your score won’t improve overnight, but it will improve. Just making payments on time for six months can notch your score up a bit. Past mistakes, like late payments, do eventually fade away. Most negative marks fall off within five to seven years. In the meantime, do your best to live within your means, create a budget that’ll help you navigate debt, and be diligent.

Get Your Free Credit Report

We won’t name names, but be cautious of websites that advertise continual access to your credit report. Some of those sites are scams, while others just provide an estimated, often incorrectly inflated, credit score number. The official way to obtain your free reports? Visit AnnualCreditReport.com. You’re legally entitled to a free credit report each year from each of the major three credit bureaus, so take advantage!

Lost or Stolen Card?

We’re here to help. If your card has been misplaced or stolen, we’ll act quickly to protect your account. You can report a missing card in the following ways:

Online and Mobile Banking

Log in and follow these three easy steps:

- From the menu, select Tools

- Select Card Manager

- Report your card as Lost or Stolen*

By phone or at a Grow store

Call 800.839.6328 to speak to a team member or let us know in person at any Grow store.Notice: Taking these steps will immediately cancel your card to prevent unauthorized transactions. If you find your card later after reporting it lost or stolen, it cannot be reactivated.

*The selected card will be canceled and removed from Manage Cards when it is reported as lost. Once your new card has been issued, it will be available in Manage Cards. The replacement card will have a new card number. Your replacement card will be sent to the mailing address on your account, and you should receive it within 7 to 10 business days.

How to Find Your Routing & Account Numbers

When you make a payment online, by phone or on a mobile device, you may be asked for our routing number and your checking account number. Credit unions and banks use these numbers to identify accounts and make sure money gets where it’s supposed to be. You’ll also need to provide your routing and checking account numbers for:

- Direct deposits

- Electronic checks

- Military allotments

- Wire transfers

Where to Find Your Routing & Checking Account Numbers

Your personal checks include both our routing number and your account number, as shown on the Grow check example below.

Where to Find Your Checking Account Number in Grow Online and Mobile Banking

If you don’t have a physical check on hand, you can also locate your Checking Account Number for Electronic Transactions in Grow Online and Mobile Banking.*

Here’s how to find it:

- In the Grow Mobile Banking app, select your checking account, then tap Show Details in the top right corner.

- In Grow Online Banking, select your checking account, then click Account Details.

Don’t have a Grow check or Online Banking? No worries.

Visit any Grow store or call us and ask for a Direct Deposit Form. It lists both your routing number and checking account number.

Making a Loan Payment

When it comes to making payments, we try to make it as painless as possible to pay your loan every month. We have several different ways to pay, including convenient online options.

Pay Online

You have two ways to pay online by transferring funds from another bank or credit union.

- Grow Online Banking (Preferred payment method for any loan)

This is the simplest way to pay your loan. You can make one-time payments or set up automatic recurring payments in Grow Online Banking. Once you log in, select “Transfer/Payments” from the menu. If you’re not enrolled in Grow Online Banking yet, you can set up your account in just a few minutes.

Log In

- Debit Card or ACH (Available for auto, personal loans and HELOCs)

Note: ACH and debit card payments are not available for credit cards or most mortgages, except HELOCs.

We accept ACH payments with no additional fees, consumer Mastercard® and Visa® debit cards with a convenience fee of $4.95, or commercial Mastercard® and Visa® debit cards with a convenience fee of 2.95% of the payment amount. To get started with an online ACH or debit card payment, select Pay Now below.

Pay Now

Pay by Mail

You can also pay any Grow loan by check through the mail. Please remember to include your account number and Grow loan number on the check. (For credit card payments, please do not write your 16-digit credit card number on the check, which can cause a delay in processing the payment.)

Address for auto, credit card, personal loan and HELOC payments:

Grow Financial Federal Credit Union

P.O. Box 75466

Chicago, IL 60675-5466Address for personal first or second mortgages and home equity payments:

Grow Financial Federal Credit Union

P.O. Box 11733

Newark, NJ 07101-4733You Are About To Leave GrowFinancial.org

At certain places on this site, there are links to other websites. Grow Financial Federal Credit Union does not endorse, approve, represent, certify or control those external sites. The credit union does not guarantee the accuracy, completeness, efficacy, timeliness or accurate sequencing of the information contained on them. You will not be represented by Grow Financial Federal Credit Union if you enter into a transaction. Privacy and security policies may differ from those practiced by the credit union. Click CONTINUE if you wish to proceed.