January 28, 2021

Sending a Wire Transfer? Here’s What You’ll Need To Know

A wire transfer is a popular a way to send funds electronically to another recipient. Two of the most common uses of wire transfers are for purchasing a home and sending money to relatives abroad, though there are lots of other situations when a wire transfer might be useful. Wire transfers can be domestic or international, with each having associated fees and processing time. Below you’ll find information about what’s needed to send a domestic or an international wire transfer, along with answers to frequently asked questions.

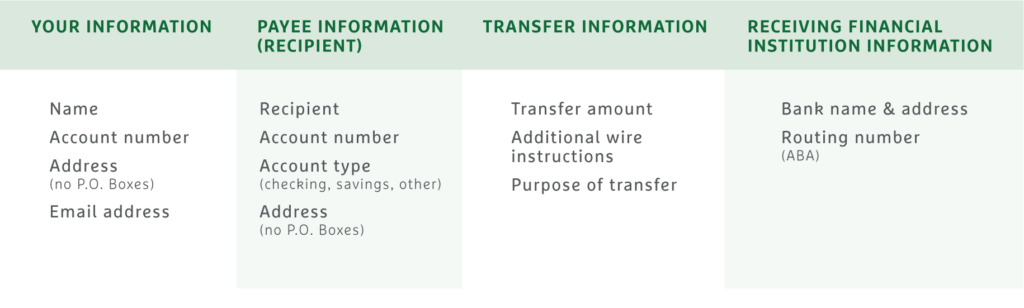

To send a domestic wire, please bring:

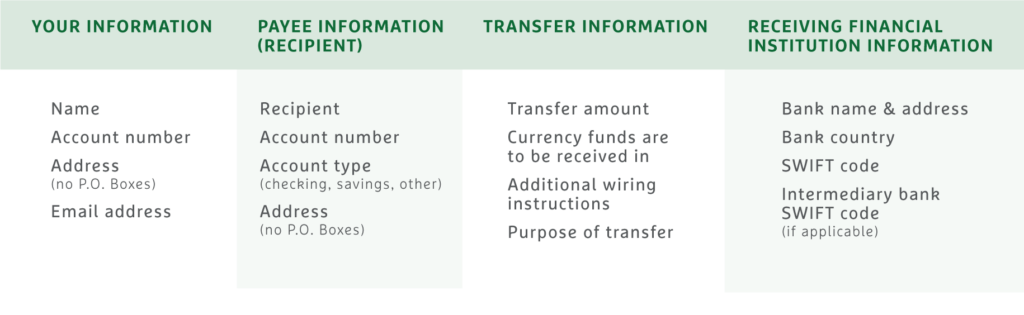

To send an international wire, please bring:

Beware of wire scams and fraud.

When sending money electronically, there are various opportunities for hackers and scammers to commit fraud. One very common use of wires — making payments when purchasing a home, whether to the title company or real estate professional — is a frequent target for fraud. Hackers may send phishing emails designed to obtain your personal information. They may even impersonate the title agency, often convincingly, in an attempt to get you to send money to the wrong place. Always verify routing numbers and receiving financial institution information before sending wires, and never send wires to anyone you don’t know personally or haven’t verified for a specific purpose.

Still have questions? Ask away.

How long does it take to send a wire transfer?

A domestic wire transfer is processed on the same day you initiate it and can be received within a few hours. To allow processing time, the transfer must be initiated by 3 pm EST. International wire transfers are typically delivered within two business days and must be initiated by 1:30 pm EST. For either type of wire transfer, please make sure to bring the required information, listed in the tables above, to one of our branch locations.

How much does it cost to send a wire transfer?

We apply a fee to send the wire transfer, and the receiving financial institution may have their own fee as well, especially for international transactions. You can find our current fees below:

Personal Fee Schedule

Business Fee Schedule

What is a SWIFT code and ABA routing number?

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) is a cooperative organization that links many financial institutions all over the world, and SWIFT provides unique codes that identify specific financial institutions. The SWIFT code is used in international wire transfers and will be between 8 and 13 digits. An ABA routing number is a 9-digit code used to identify financial institutions and accounts within the United States and is needed for domestic wire transfers. You will want to confirm the receiving financial institution’s unique codes directly from the institution to avoid fraud.

What is an intermediary bank?

In some international wires, an intermediary bank may be used, which serves as a middleman between the sending and receiving financial institutions. This often occurs when two countries don’t have a direct or established financial relationship.

Posted In: