- Personal

- Membership

- Membership

- Rates & Fees

- Checking

- Checking

- Personal Loans

- Personal Loans

- Wealth Management

- Investment Services

- Financial Advisors

- Resource Center

- Business

January 28, 2021

Sending a Wire Transfer? Here’s What You’ll Need To Know

A wire transfer is a popular a way to send funds electronically to another recipient. Two of the most common uses of wire transfers are for purchasing a home and sending money to relatives abroad, though there are lots of other situations when a wire transfer might be useful. Wire transfers can be domestic or international, with each having associated fees and processing time. Below you’ll find information about what’s needed to send a domestic or an international wire transfer, along with answers to frequently asked questions.

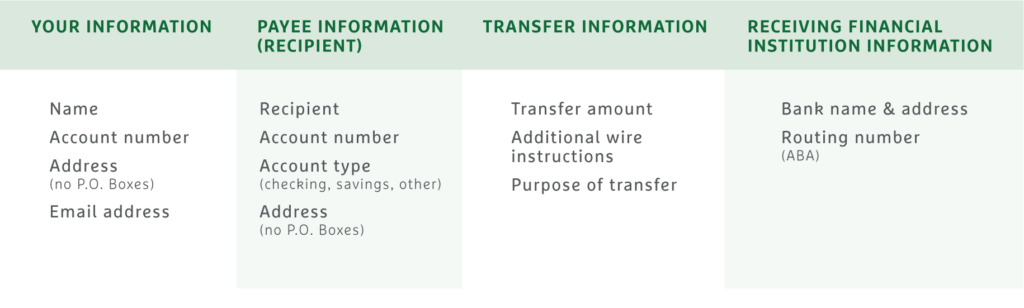

To send a domestic wire, please bring:

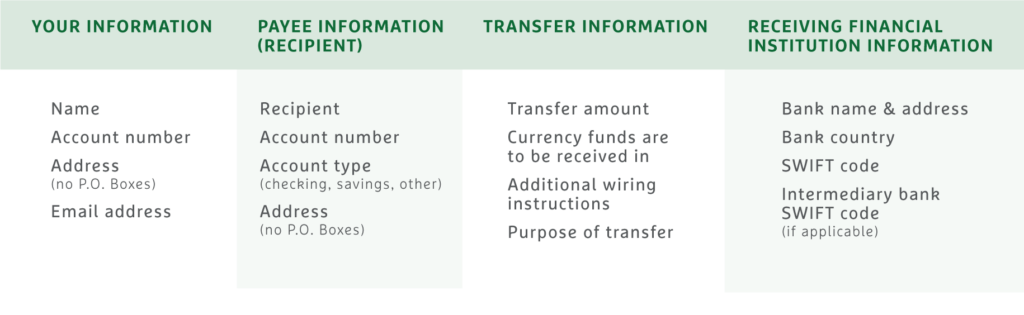

To send an international wire, please bring:

Beware of wire scams and fraud.

When sending money electronically, there are various opportunities for hackers and scammers to commit fraud. One very common use of wires — making payments when purchasing a home, whether to the title company or real estate professional — is a frequent target for fraud. Hackers may send phishing emails designed to obtain your personal information. They may even impersonate the title agency, often convincingly, in an attempt to get you to send money to the wrong place. Always verify routing numbers and receiving financial institution information before sending wires, and never send wires to anyone you don’t know personally or haven’t verified for a specific purpose.

Still have questions? Ask away.

How long does it take to send a wire transfer?

A domestic wire transfer is processed on the same day you initiate it and can be received within a few hours. To allow processing time, the transfer must be initiated by 3 pm EST. International wire transfers are typically delivered within two business days and must be initiated by 1:30 pm EST. For either type of wire transfer, please make sure to bring the required information, listed in the tables above, to one of our branch locations.How much does it cost to send a wire transfer?

We apply a fee to send the wire transfer, and the receiving financial institution may have their own fee as well, especially for international transactions. You can find our current fees below:

Personal Fee Schedule

Business Fee ScheduleWhat is a SWIFT code and ABA routing number?

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) is a cooperative organization that links many financial institutions all over the world, and SWIFT provides unique codes that identify specific financial institutions. The SWIFT code is used in international wire transfers and will be between 8 and 13 digits. An ABA routing number is a 9-digit code used to identify financial institutions and accounts within the United States and is needed for domestic wire transfers. You will want to confirm the receiving financial institution’s unique codes directly from the institution to avoid fraud.What is an intermediary bank?

In some international wires, an intermediary bank may be used, which serves as a middleman between the sending and receiving financial institutions. This often occurs when two countries don’t have a direct or established financial relationship.

Posted In:

Lost or Stolen Card?

We’re here to help. If your card has been misplaced or stolen, we’ll act quickly to protect your account. You can report a missing card in the following ways:

Online and Mobile Banking

Log in and follow these three easy steps:

- From the menu, select Tools

- Select Card Manager

- Report your card as Lost or Stolen*

By phone or at a Grow store

Call 800.839.6328 to speak to a team member or let us know in person at any Grow store.Notice: Taking these steps will immediately cancel your card to prevent unauthorized transactions. If you find your card later after reporting it lost or stolen, it cannot be reactivated.

*The selected card will be canceled and removed from Manage Cards when it is reported as lost. Once your new card has been issued, it will be available in Manage Cards. The replacement card will have a new card number. Your replacement card will be sent to the mailing address on your account, and you should receive it within 7 to 10 business days.

How to Find Your Routing & Account Numbers

When you make a payment online, by phone or on a mobile device, you may be asked for our routing number and your checking account number. Credit unions and banks use these numbers to identify accounts and make sure money gets where it’s supposed to be. You’ll also need to provide your routing and checking account numbers for:

- Direct deposits

- Electronic checks

- Military allotments

- Wire transfers

Where to Find Your Routing & Checking Account Numbers

Your personal checks include both our routing number and your account number, as shown on the Grow check example below.

Where to Find Your Checking Account Number in Grow Online and Mobile Banking

If you don’t have a physical check on hand, you can also locate your Checking Account Number for Electronic Transactions in Grow Online and Mobile Banking.*

Here’s how to find it:

- In the Grow Mobile Banking app, select your checking account, then tap Show Details in the top right corner.

- In Grow Online Banking, select your checking account, then click Account Details.

Don’t have a Grow check or Online Banking? No worries.

Visit any Grow store or call us and ask for a Direct Deposit Form. It lists both your routing number and checking account number.

Making a Loan Payment

When it comes to making payments, we try to make it as painless as possible to pay your loan every month. We have several different ways to pay, including convenient online options.

Pay Online

You have two ways to pay online by transferring funds from another bank or credit union.

- Grow Online Banking (Preferred payment method for any loan)

This is the simplest way to pay your loan. You can make one-time payments or set up automatic recurring payments in Grow Online Banking. Once you log in, select “Transfer/Payments” from the menu. If you’re not enrolled in Grow Online Banking yet, you can set up your account in just a few minutes.

Log In

- Debit Card or ACH (Available for auto, personal loans and HELOCs)

Note: ACH and debit card payments are not available for credit cards or most mortgages, except HELOCs.

We accept ACH payments with no additional fees, consumer Mastercard® and Visa® debit cards with a convenience fee of $4.95, or commercial Mastercard® and Visa® debit cards with a convenience fee of 2.95% of the payment amount. To get started with an online ACH or debit card payment, select Pay Now below.

Pay Now

Pay by Mail

You can also pay any Grow loan by check through the mail. Please remember to include your account number and Grow loan number on the check. (For credit card payments, please do not write your 16-digit credit card number on the check, which can cause a delay in processing the payment.)

Address for auto, credit card, personal loan and HELOC payments:

Grow Financial Federal Credit Union

P.O. Box 75466

Chicago, IL 60675-5466Address for personal first or second mortgages and home equity payments:

Grow Financial Federal Credit Union

P.O. Box 11733

Newark, NJ 07101-4733You Are About To Leave GrowFinancial.org

At certain places on this site, there are links to other websites. Grow Financial Federal Credit Union does not endorse, approve, represent, certify or control those external sites. The credit union does not guarantee the accuracy, completeness, efficacy, timeliness or accurate sequencing of the information contained on them. You will not be represented by Grow Financial Federal Credit Union if you enter into a transaction. Privacy and security policies may differ from those practiced by the credit union. Click CONTINUE if you wish to proceed.